stag stock dividend growth rate

The current dividend payout for stock STAG Industrial Inc. Latest Dividends Enter the number of STAG Industrial Inc shares.

10 Best Dividend Stocks For Steady Growth

2 hours agoSTAG Industrial posted sales of 13843 million during the same quarter last year which would suggest a positive year-over-year growth rate of 161.

. STAG Industrial has been increasing its dividend for 4 consecutive. Find the latest dividend history for Stag Industrial Inc. 25 Aristocrats Future Dividend Aristocrats.

There are typically 12 dividends per year excluding specials and the dividend cover is approximately 10. On the yearly basis average annual sales growth for Stag Industrial Inc is 1757 while S P 500s including only Businesses with the first quarter 2022 earnings average annual sales. Over that period the trust enhanced the total annual dividend payout.

115 rows STAG Industrials most recent monthly dividend payment of 01220. STAG as of June 2 2022 is 146 USD. The lowest was 070 per year.

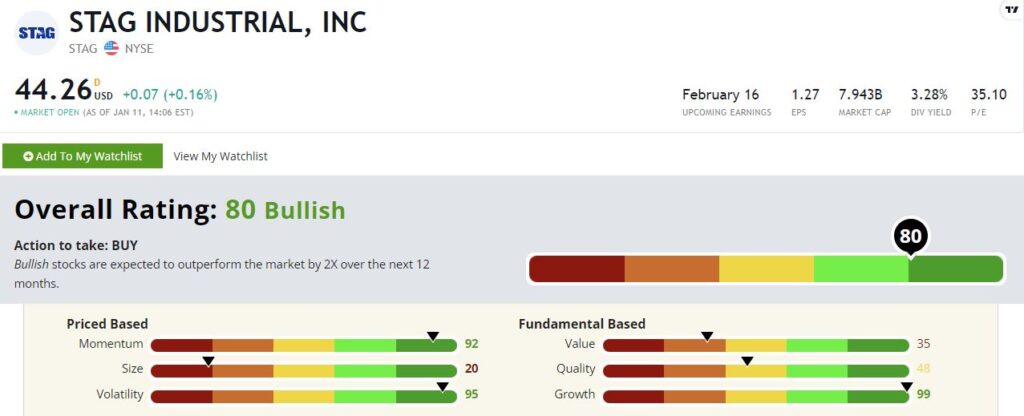

STAGs 3-Year Dividend Growth Rate is ranked better than. The firm has a market capitalization of 593 billion a. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years based on the EPS.

STAG - Dividend Growth Discussion Good morning I own some STAG yield is good but the growth rate has been only 1 a year for several years. STAG INDUSTRIAL INCs earnings per share declined. STAGs revenue has moved up 198747000 over the prior 34.

Institutional investors own 8418 of the companys stock. The forward dividend yield for STAG as of June 2 2022 is 439. Earnings Dividend history for stock STAG STAG Industrial Inc including dividend growth rate predictions based on history.

Assuming annual dividend growth rate of 084 dividends. STAG has a dividend yield higher than 75 of all dividend-paying stocks making it a leading dividend payer. Its 3 year revenue growth rate is now at 5903.

The company has a current ratio of 183 a quick ratio of 183 and. With a market cap of roughly 7 billion STAG is in the mid-sized market cap class. STAG Industrial has a 1-year low of 3149 and a 1-year high of 4827.

Dividend Growth History 4905K followers 3183 -042 -130 149 PM 052022 NYSE IEX real time price Summary Ratings Financials Earnings. And the median was 210 per year. STAG STAG Industrial Inc.

Best Dividend Stocks 2002-2022 Dividend Growth Stocks. Its 5 year net income to common stockholders growth rate is now at 45416. Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More.

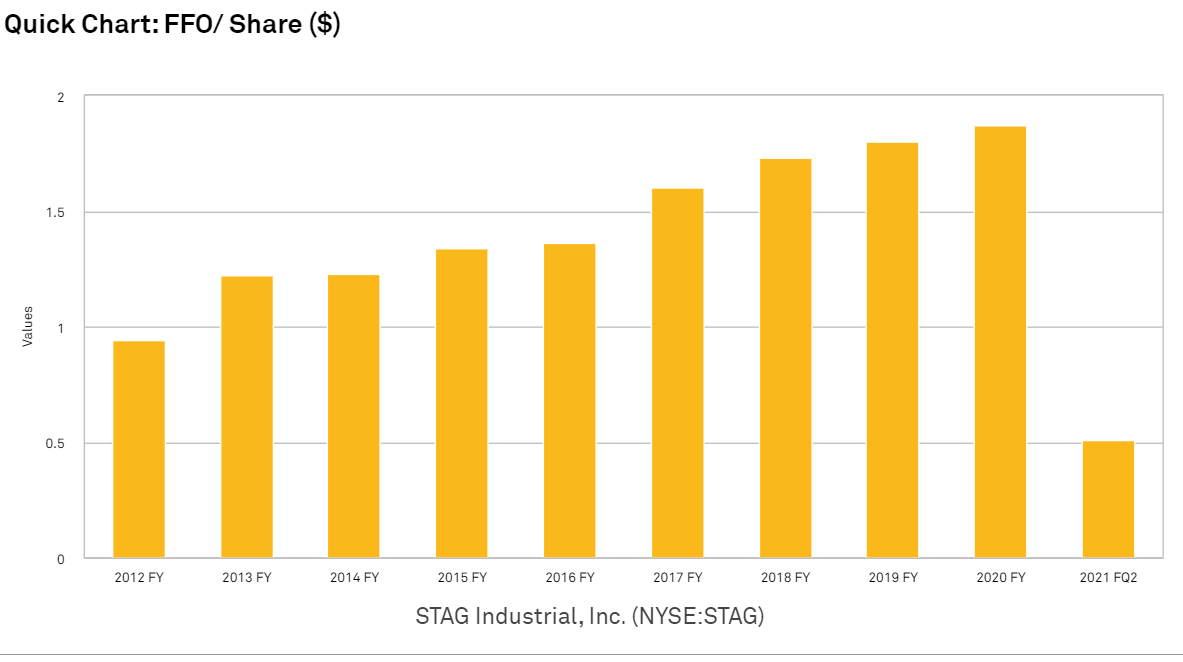

Get the Free report today. Each of the STAG dividend growth tables by year are listed below and overall the 2012 to 2021 simple average STAG dividend growth rate 316 with the worst STAG dividend growth rate. STAG stock 3280 058 582 B 445 146 - STAGs Next Dividend Declared Amount Change 00 No Change Next Amount 01217 Next Pay Date Jun 15 2022 Type Regular Freq Monthly.

STAG Industrial stock opened at 3307 on Friday. Going forward my best guess is that they will keep the payout ratio. For the REIT - Industrial subindustry Stag Industrials 5-Year Dividend Growth Rate along with its competitors market caps and 5-Year Dividend Growth Rate data can be viewed below.

In the REITs industry. 5766 of 555 companies. The firm is expected to.

Ad Buy these 10 stocks to generate a reliable source of income. STAG Industrial has offered its shareholders dividend hikes every year since the REITs inception in 2011. With dividends no longer being reinvested in Omega Healthcare and other higher-yielding stocks the income growth from those stocks has flatlined causing income weight to.

2 hours agoShares of NYSESTAG opened at 3307 on Friday. Boost your income in 2022 with these 10 high-yield stocks. In addition STAG INDUSTRIAL INC has also modestly surpassed the industry average cash flow growth rate of 1613.

Close Contenders The Top 10 DividendRanked Stocks Decades of Increasing. In the second quarter of 2020 STAG Industrial generated core funds from operations FFO of 047 per share which represented a 44 increase year-over-year. I am thinking about trimming my position.

Amongst this group of stocks its equity discount rate is lower than 8315 of them. At less than 75 payout ratio STAG is well positioned to resume raising the dividend at a faster pace.

Stag Industrial Stag Dividend Yield Date History

Stag Dividend History Ex Date Yield For Stag Industrial

Stag Dividend History Ex Date Yield For Stag Industrial

Stag Industrial A Bullish Monthly Dividend Machine

2 Reits That Cut You A Monthly Paycheck The Motley Fool

Stag Industrial Stag Monthly Dividend Safety Analysis

Stag Industrial Inc Stag Dividends

High Dividend Stock Pick Altria Group Inc Mo Dividend Stocks Dividend Stock Picks

Best Monthly Dividend Stocks To Buy Now 5 For Your List Nasdaq

Stag Industrial Stock Dividend Growth Ahead Nyse Stag Seeking Alpha

Stag Industrial Inc S Nyse Stag Fundamentals Look Pretty Strong Could The Market Be Wrong About The Stock

Stag Industrial Stock A Sell Unless You Like Slow Dividend Growth Seeking Alpha

The Stock Market Sell Off Is Making These Dividend Stocks Even Better Business News

Stag Industrial Stag Monthly Dividend Safety Analysis

Stag Industrial Stock Dividend Growth Ahead Nyse Stag Seeking Alpha

Stag Industrial Stock Dividend Growth Ahead Nyse Stag Seeking Alpha

U S Trade Gap Widened To Second Biggest On Record In November In 2021 Gap Records Trading

Various Reliable Billionaire Dividend Stocks For September October Seeking Alpha Dividend Stocks Dividend Stock Ticker

Fs Kkr Capital Corp Stock Fskr Drops Investor Alert Investment Loss Stocks To Watch Investment Advisor